These errors would relate to issues between what a vendor is charging you and the inventory, services, or supplies that you have received. Accelerating people and processes with modern security tools and frameworks to provide security capabilities https://www.online-accounting.net/ that are uniquely available on the AWS Cloud. These products complement existing AWS services to help you deploy a comprehensive security architecture and a more seamless experience across your cloud and on-premises environments.

What Appears on a Bank Reconciliation Statement?

Many of the household accounting software names, such as QuickBooks, Xero and Zoho Books, can be classified as integrated accounting software solutions. For lawyers, reconciliation in accounting is essential for ensuring that financial records are accurate, consistent, and transparent. While proper reconciliation is the standard for how law firms should handle all financial accounts, it is particularly important—and often required—for the management of trust accounts. Legal software for trust accounting can help you track transactions and reconcile records and bank statements. Clio’s Trust Account Management features, for example, allow you to manage your firm’s trust accounting, reconcile directly in Clio, and run built-in legal trust account reports. A three-way reconciliation is a specific accounting process used by law firms to check that the firm’s internal trust ledgers line up with individual client trust ledgers and trust bank statements.

Interested in learning more about FloQast AutoRec? Check out this on-demand demo!

First, there are some obvious reasons why there might be discrepancies in your account. If you’ve written a check to a vendor and reduced your account balance in your internal systems accordingly, your bank might show a higher balance until the check hits your account. Similarly, if you were expecting an electronic payment in why are accruals needed every month one month, but it didn’t actually clear until a day before or after the end of the month, this could cause a discrepancy. If there are any differences between the accounts and the amounts, these differences need to be explained. Reconciling your bank statements allows you to identify problems before they get out of hand.

What is Account Reconciliation? – Process, Types & Best Practices

As CEO and Co-Founder, Mike leads FloQast’s corporate vision, strategy and execution. Prior to founding FloQast, he managed the accounting team at Cornerstone OnDemand, a SaaS company in Los Angeles. Finally, look for the transactions that are in the general ledger, but not on the statement, and vice versa. Do you need to record the bank fees or credit card interest in the general ledger? Next, match the entries in the general ledger with transactions on the statement.

How Often Should a Business Reconcile Its Accounts?

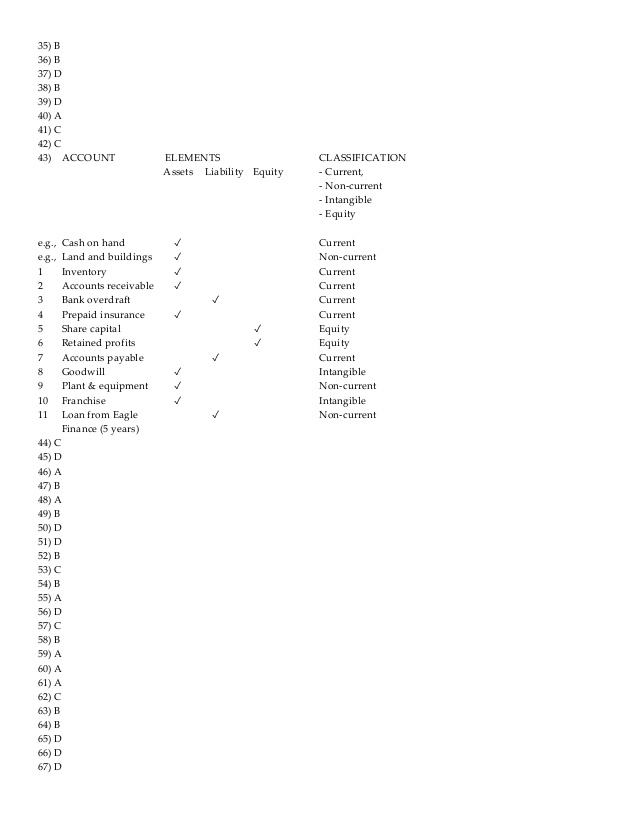

Accountants typically perform an account reconciliation for all their asset, liability, and equity accounts. This process involves reconciling credit card transactions, accounts payable, accounts receivable, payroll, fixed assets, and subscriptions to ensure that all are properly accounted for and balanced. Account reconciliation is the process of cross-checking a company’s financial records with external documents, such as bank statements. Its purpose is to ensure accuracy and consistency of financial data, which is vital for informed decision-making and maintaining financial integrity. This type of reconciliation also helps minimize currency and financial costs and helps reduce bank transaction fees and optimize the company’s liquidity. Any errors and discrepancies found can be corrected to ensure that the company’s consolidated financial statements are accurate and represent the correct financial picture.

The Reconciliation Process

This report was designed to give users access general ledger financial and budgetary transactions for query and analysis. Users may query the data warehouse in detail, including the option to search and find unique transactions within the details of the General Ledger. Accounts Payable teams must adhere to the important features of accurate, regular vendor reconciliation. By doing so, they can maintain good vendor relationships, detect fraud, and support audit trails. Vendor Reconciliation is a critical practice to ensure the company’s balances are correctly owed to the vendors. Another example is reconciling the balance in the general ledger account Utilities Payable.

This schedule of activity should support the general ledger ending balance for each account. To verify the general ledger account for each type of prepaid asset, check the balances of prepaid assets for the beginning balance plus any transaction additions minus time passage reductions to equal the ending balance. This is the most common method, involving a thorough examination of each transaction to confirm that the recorded amount matches the actual expenditure. Documentation review is preferred for its accuracy, relying on real information rather than estimates. The important thing is to establish internal processes for account reconciliation and adhere to those processes. And while most financial institutions do not hold you responsible for fraudulent activity on your account, you may never know about that fraudulent activity if you don’t reconcile those accounts.

If any transaction has been missed in the records of either of the companies, that can be recorded too. This type of reconciliation is used by businesses to reconcile the balances of bills and invoices of customers, which are yet to be paid by the customers and hence yet to be received by the business. These bills and invoices are matched to the individual balances owed by each customer against each invoice and then the overall balance of accounts receivable. It helps keep a proper track of outstanding amounts owed by the customers and further helps the business correct any errors or inaccuracies in customer accounts before the financial statements are published.

When a parent company has several subsidiaries, the process helps identify assets. These may be the result of billing mistakes related to loans, deposits, and payment processing activities. This is true for both those within a company and those looking in from the outside. But, generally accepted accounting principles (GAAP) demand double-entry accounting.

- The prior month’s journal entry accruals need to be reversed to prevent a discrepancy.

- These products complement existing AWS services to help you deploy a comprehensive security architecture and a more seamless experience across your cloud and on-premises environments.

- Where the company’s current revenue is recorded to be $4.5 million, the analytical review method shows the company that this revenue size is way below its historical average and indicates the presence of discrepancies.

- All trust transactions in the internal ledger should be accurately recorded and should align with transactions in the individual client ledgers.

- The primary objective of reconciliation is to identify and resolve any discrepancies between the two sets of records.

- Nanonets automates the reconciliation process, ensuring that it is completed promptly.

Account reconciliation is an internal control that certifies the accuracy and integrity of an organization’s financial processes. In such a situation, there can be inter-company deposits made, depending on the requirements of different companies. However, since each of the group companies has its legal entity and the books of accounts also need to be maintained separately. To ensure that all cash balance, liabilities, and assets are updated, periodic accounts reconciliation is required. A business will observe the money leaving its accounts to calculate whether it matches the actual money spent.

For example, a company can estimate the amount of expected bad debts in the receivable account to see if it is close to the balance in the allowance for doubtful accounts. The expected bad debts are estimated based on the historical activity levels of the bad debts allowance. After scrutinizing the account, the accountant detects an accounting error that omitted a zero when recording entries. Rectifying the error brings the current revenue to $90 million, which is relatively close to the projection. In this section, we look at some examples of accounts reconciliation to understand the scope of work involved in accounts reconciliation and the tools that can help ease the process.

Today, most accounting software applications will perform much of the bank reconciliation process for you, but it’s still important to regularly review your statements for errors and discrepancies that may appear. Regularly reconciling your accounts, especially bank accounts and credit card statements can also help you identify suspicious activity and investigate it immediately, rather than months after it has occurred. And if you never reconcile your accounts, chances are that fraudulent activity will continue.

The accountant adjusts the accounts payable to $4.8 million, which is the approximate amount of the estimated accounts payable. HighRadius’ Account Reconciliation software combines artificial intelligence (AI) and machine learning (ML) to ensure account reconciliations are done quickly and accurately. Often the cash balance in the book of accounts and the bank accounts may not match. This could be due to many causes like missed entries, bounced payments, charges incurred, interest accrued, and much more. While the entries in the general ledger are based on the facts of the moment, they may not always be accurate. But there are chances that the check could have bounced due to numerous reasons.

Accountants then make research, investigate, and take appropriate actions to correct the discrepancies. As noted earlier, discrepancies are caused by various factors like timing differences, https://www.accountingcoaching.online/average-inventory-definition/ missing transactions, mistakes, or fraud, among others. Overall, account reconciliation plays an important role in a company’s risk management framework relating to accounting.

Accounts receivable details may not match the general ledger if customer invoices and credits are accrued and not entered individually into the aged accounts receivable journal. Customer account write-offs must be recorded against the Allowance for Doubtful Accounts, which nets against Accounts Receivable in financial statements. These types of account reconciliation are crucial for maintaining financial accuracy, compliance with regulations, and preventing errors or discrepancies that could impact the overall financial health of a business.